SCBX supports ‘Sustainable Banking Guidelines – Responsible Lending’ for both retail and business lending.

SCBX firmly believes that integrating ESG consideration into its underwriting process will help improve decision-making on investment advisory, increase risk-adjusted returns in the long term, and also prevent and alleviate negative externalities while fostering beneficial impacts to the society.

At SCBX Group, we fully support the practice of responsible marketing and advertising with an aim to uphold customer confidence and ultimately, the public trust across the SCBX Group. We are committed to continue to monitor and improve guardrails to ensure that our advertising and marketing activities strictly follow SCBX Responsible Lending and Market Conduct Policies along with the established Frameworks per the Bank of Thailand’s expectation.

Both preventive controls and monitoring mechanisms across the 3 lines of defense have been established to oversee the accuracy and comprehensiveness of the advertising and marketing materials on products and services being offered by each entity within the Group. This is to avoid any misrepresentation of any information to allow our customers to make informed decision in acquiring any of our products and/or services, particularly those concerning advertisements and marketing campaigns on loan products as they shall not encourage customers to borrow unnecessarily and excessively. Thus, ‘ Borrow When Necessary and Within Their Means,’ would be explicitly stated on all of the advertisements and marketing materials in relation to loan products of the SCBX Group.

Apart from these marketing and advertising materials, sales staff are also crucial as they play a key role in ensuring that customers are fully aware on the cost and benefit of products and/or services offered by the SCBX Group. Thus, these staff, new or existing alike, are subject to continuously attend responsible lending training courses apart from market conduct and other mandatory courses to constantly reminding them to always remain vigilant of these requirements.

Retail Customer

Apart from income and credit risks, SCB’s retail credit underwriting process examines the debt service ratio (DSR) as well as borrower’s affordability and living expense, so as to present financial products and services that cater to each customer’s demand without undermining their well-being.

Corporate Customer and Project Finance

SCB considers environmental and social issues as a part of the Bank’s Credit Policy Guide, and identifies the Exclusion List and credit underwriting guidance for specific industries. Furthermore, the Bank’s lending procedures are aligned with the Equator Principles and guidelines by the International Finance Corporate (IFC).

The Bank’s project finance process aligns with the responsible lending policy and guidance from building customer relationships, sales and credit analysis, developing environmental and social risk assessment guidelines for project finance, and communicating the guidelines to all relevant employees to ensuring thorough compliance.

The First Thai Equator Principles Financial Institution, Uplifting responsible lending practices to a global standard

Believing that banking and financial sectors can play important roles in contributing to the development of sustainable society and environment, SCB is committed to its ‘Sustainable Finance’ principle with a mission to provide lending responsibly and in line with the Sustainable Banking Guidelines – Responsible Lending from the Bank of Thailand and Thai Bankers Association. This was done by integrating environmental, social, and governance considerations into the Bank’s lending policy, strategy, risk management process, and management of impacts resulting from the Bank’s financial support, especially project finance for large industrial projects, such as power plants, basic infrastructure, mining, and industrial complex, that may cause significant negative impacts on environment and society if proper management is absent.

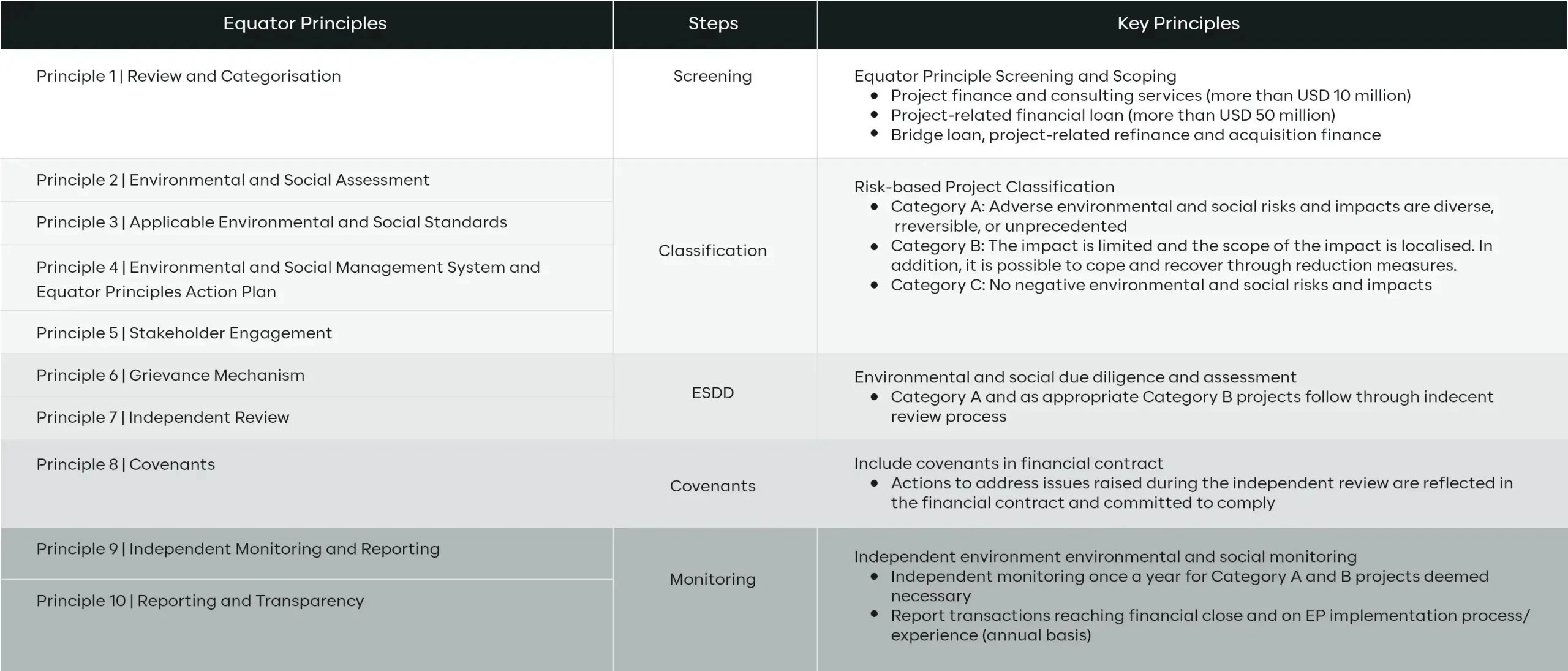

To uplift the Thai banking industry, and to ensure that SCB is providing financial support to projects with appropriate environmental and social management to its identified characteristics and risk level, SCB became a signatory to the Equator Principles (EP) Association and adoped the 10 EP principles, a globally accepted standards on environmental and social management for project finance. The Bank implemented these principles as guidelines on approach to systematically identify, assess, and manage environmental, and social risk associated with project finance financially supported by the Bank.

Committed to compliance with the Equator Principles to systematically identify, assess, and manage environmental, and social risk associated with project finance

The First Thai Equator Principles Financial Institution, Uplifting responsible lending practices to a global standard

Believing that banking and financial sectors can play important roles in contributing to the development of sustainable society and environment, SCB is committed to its ‘Sustainable Finance’ principle with a mission to provide lending responsibly and in line with the Sustainable Banking Guidelines – Responsible Lending from the Bank of Thailand and Thai Bankers Association. This was done by integrating environmental, social, and governance considerations into the Bank’s lending policy, strategy, risk management process, and management of impacts resulted from the Bank’s financial support, especially project finance for large industrial projects, such as power plants, basic infrastructure, mining, and industrial complex, that may cause significant negative impacts on environment and society if proper management is absent.

To uplift the Thai banking industry, and to ensure that SCB is providing financial support to projects with appropriate environmental and social management to its identified characteristics and risk level, SCB became a signatory to the Equator Principles (EP) Association and adopts the 10 EP principles, a globally accepted standards on environmental and social management for project finance. The Bank implemented these principles as guidelines on approach to systematically identify, assess, and manage environmental, and social risk associated with project finance financially supported by the Bank.

Committed to compliance with the Equator Principles to systematically identify, assess, and manage environmental, and social risk associated with project finance

The Bank believes that improvements to its lending policy and process through the implementation of EPs, which follow approach and practice specified by International Finance Corporation (IFC), World Bank, and other leading financial institutions, not only assist its clients in systematically managing environmental and social impacts resulting from the project but also benefits the Bank by putting in place a mechanism for cooperation with independent environmental and social issues assessment experts while helping to identify subsequent mitigation measures and monitoring its implementation as specified in lending covenants.

Our path towards becoming an Equator Principles Financial Institution (EPFI)

Enhancing Management Efficiency through the Sustainable Finance Framework and Policy

In 2024, SCBX worked with external experts to develop the ‘SCBX Group Sustainable Finance Framework’ based upon internationally recognized standards and principles. This framework ensures the seamless integration of ESG factors into our financial and investment products while strengthening risk management practices across SCBX operations.

SCBX Group Sustainable Finance Framework

Concurrently, SCB continues to align its management approach with the sustainability frameworks and policies, including:

- Sustainable Finance and Advisory Statement

- Statement on Fossil Fuel Financing

- Responsible Investment Advisory Policy

- Sustainability Investment Policy, and

- Environmental, Social, and Governance Risk Management Policy

The above frameworks and policies provide comprehensive and actionable guidelines tailored to the responsibilities of respective client groups, alongside an Exclusion List to prevent and mitigate potential negative externalities while identifying opportunities to foster positive environmental and social impacts through financial support and investment. These initiatives are overseen by SCB’s Board of Directors and executives to ensure effective implementation and accountability.

Adopting the Equator Principles

The Bank integrates the Equator Principles as a component of its credit process. At the same time, the Bank is building engagement with relevant business units, including Wholesale Banking Group, SME Banking, Risk Office, and Strategy Group (Corporate Sustainability Function), with guidance from external environmental and social consultants in order to support policy implementation. In 2021, SCB developed manuals and tools, and provided EP training to over 300 personnel in relevant business units. The two sessions sought to provide knowledge, understanding, and uplift their capabilities in adopting the Equator Principles.

1. International Finance Corporation Performance Standard:

For management and personnel to understand different types of environmental and social impacts associated with project finance, as well as its systematic risk management approach, in consistency with International Finance Corporation (IFC) practice.

2. The Equator Principles: For management and personnel to understand principles and requirements in adopting the 10 principles along with expected roles and responsibilities.

Responsible Lending

Large-scale projects may cause significant impacts on the environment and society if not adequately monitored. Recognizing these risks, SCB adopted the Responsible Lending Policy in 2018 and became the first Thai financial institution to join the Equator Principles (EP) Association as a signatory in 2022, endorsing the ten international principles for risk oversight into the credit underwriting process for large-scale projects. This approach involves identifying, evaluating, and managing environmental and social risks associated with project finance to ensure that the Bank supports projects with adequate management approaches corresponding to their respective characteristics and risk levels. This reflects SCB’s aspiration to elevate the standards of Thailand’s financial sector and contribute to sustainable development.