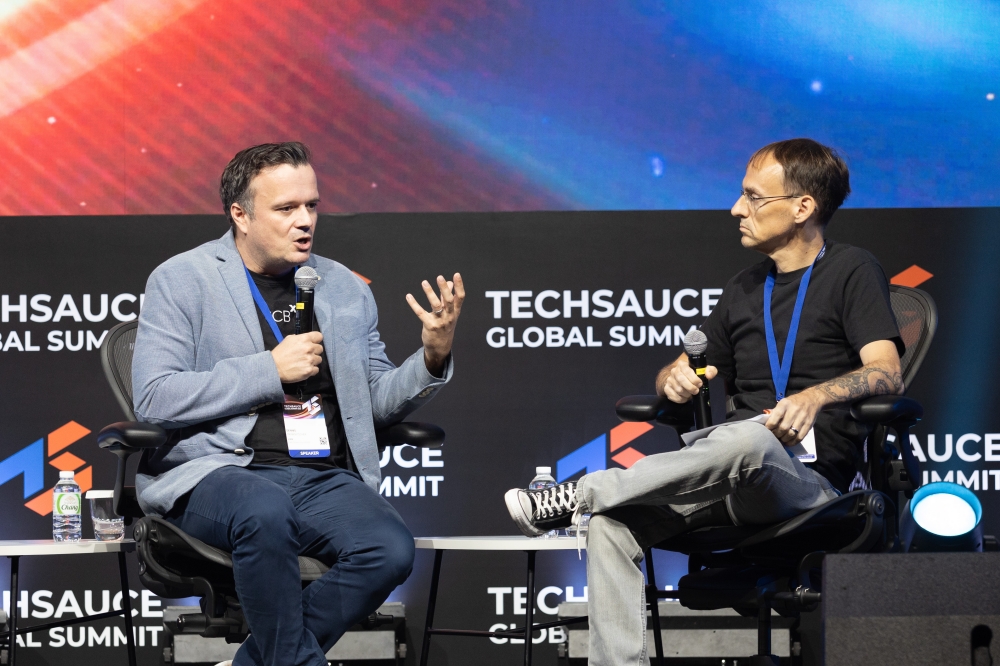

Cyber Resilience: Insights from SCBX CTO at Techsauce Global Summit

"Securing the Future of Financial Services: Navigating Cybersecurity Challenges in the Fintech Era," held at Techsauce Global Summit 2023. Among the distinguished panelists was Mr. Dennis Thorsten Trawnitschek, Chief Technology Officer of SCBX, whose insights shed light on the intricate balance between innovation, customer trust, and regulatory compliance.

The rapid advancement of technology has brought about a transformative era in the financial industry, revolutionizing the way we interact with financial services. However, this era also brings along a new set of challenges, particularly in the realm of cybersecurity.

Transparency in New Technology and Customer Data Ownership

One of the most pressing issues discussed during the panel was the transparency of new technologies in the context of customer data. Mr. Trawnitschek emphasized that in the expansive ecosystem of SCBX, where one customer could potentially be another customer under the same group, transparency is paramount. The approach taken by SCBX is to empower customers with ownership of their data. The establishment of DataX, a subsidiary of SCBX, has enabled the implementation of high standards in architecture and security—a testament to the company’s commitment to data protection. This approach aligns with SCBX’s core principle of data security, striking a delicate balance between customer trust and regulatory compliance.

Seizing the Opportunity in Cybersecurity

Mr. Trawnitschek highlighted that viewing cybersecurity as an opportunity is integral to staying ahead of the curve. The significant influx of private venture capital and investments in security underscores the potential within the market. As new challenges arise, innovative solutions can not only enhance security but also make financial institutions smarter and more resilient.

Third-Party Risks and Holistic Cybersecurity Approach

Acknowledging the interconnected nature of today’s digital landscape, Mr. Trawnitschek urged the audience to face the reality of data interdependence. A staggering 60-70 percent of risks stem from third-party entities, necessitating a paradigm shift in evaluating potential breaches. Traditional approaches fall short, demanding a proactive assessment of vendors and their potential security vulnerabilities. A thorough evaluation of third-party communication offers a more comprehensive perspective, enhancing the understanding of risks involved.

Incident Response in a Cloud-Native Environment

In the era of cloud-native operations, Mr. Trawnitschek stressed that third-party risks have gained even more prominence. The prevailing belief that cybersecurity is a one-time process is now outdated. Instead, companies must adopt a continuous incident response approach to effectively manage third-party risks, as these risks remain an ever-present concern.

Security by Design: Embedding Security Upfront

Mr. Trawnitschek’s insights shed light on the importance of integrating security measures from the outset of any technology development process. Security by design ensures that cybersecurity is not an afterthought but a fundamental aspect of the creation of new technologies, making incident response more effective and streamlined.

Leadership in Combatting Fraud and Scams

The panel also addressed the ongoing battle against fraud and scams, issues of paramount concern in the financial sector. Mr. Trawnitschek outlined a three-pronged strategy to empower customers in avoiding scams: proactive information sharing, verification from trusted sources, and leveraging data to track down scams. By fostering a culture of information sharing and leveraging technology to empower customers, financial institutions can contribute to a safer digital financial landscape.