thAI consumer

AI adoption 2026

From AI Awareness to

Consumer Trust and Adoption

— Are We Ready?

I can use and apply AI very well

I know and understand AI well and can explain it to others

I understand what AI is and have a basic understanding of how it is used

Improve my productivity

If you ask Thai consumers today, “Do you know what AI is?” most will answer “yes.” But the story runs deeper. Survey data shows that over 80% of Thai consumers have already used AI in some form—whether through product recommendations, text-summarization features, or everyday translation tools. Yet when asked, “How many use it to its full potential?” the number drops sharply to just 13%

This reveals an important insight: AI is no longer distant or unfamiliar, but it is still not trusted enough for consumers to rely on it for their financial lives. Behind early adoption lies a layer of anxiety—especially around cybersecurity and the complexity of using AI-enabled tools. Therefore, the real question is not: “Will AI play a role in daily life and personal finance?” but rather: “How do we build enough confidence and ease of use for AI to become a natural part of everyday behavior?”

Dive into this five-month study as the starting point for a new discovery—that Thai businesses must navigate for themselves. It is a dialogue based not on what AI can do, but on what Thai consumers want AI to do for them.

The Scaling Gap

Familiar but Not Yet Understood: The Gap Between Awareness and Understanding. Although more Thais are becoming familiar with the term “AI,” fewer than one in five truly understand how it actually works.

This reflects what can be called the “Invisible Usage” phenomenon — Thai consumers use AI constantly, but often don’t realize it’s AI.

Barriers to AI Adoption

The Alignment Divide

Open to using AI but remains wary of certain aspects.

Uses AI with intelligent moderation; uses it only as necessary, avoiding the hype to focus on where real benefits are seen.

Strategic

Rebalancing

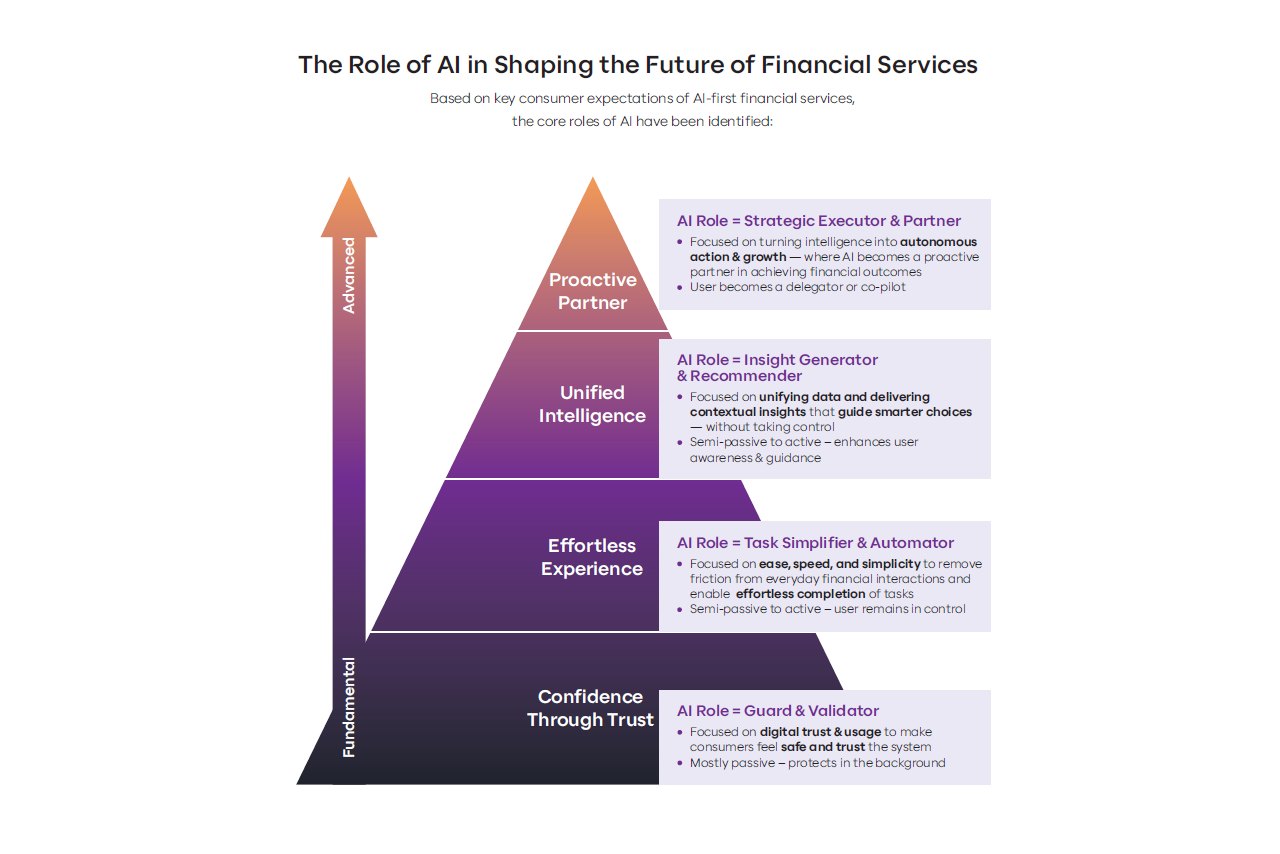

What the Data Tells Us: Trust Opens the Door, Convenience Keeps People Engaged. The deep-dive analysis in this research reveals that adopting AI for financial activities is not a linear path, but rather a four-stage pyramid:

2026 Strategy

Build trust-first AI: Trust is the foundation