The ability to systematically and effectively

manage risks in a constantly changing context

is crucial to long-term business resilience

and capabilities.

The ability to systematically

and effectively manage risks

in a constantly changing

context is crucial to

long-term business resilience

and capabilities.

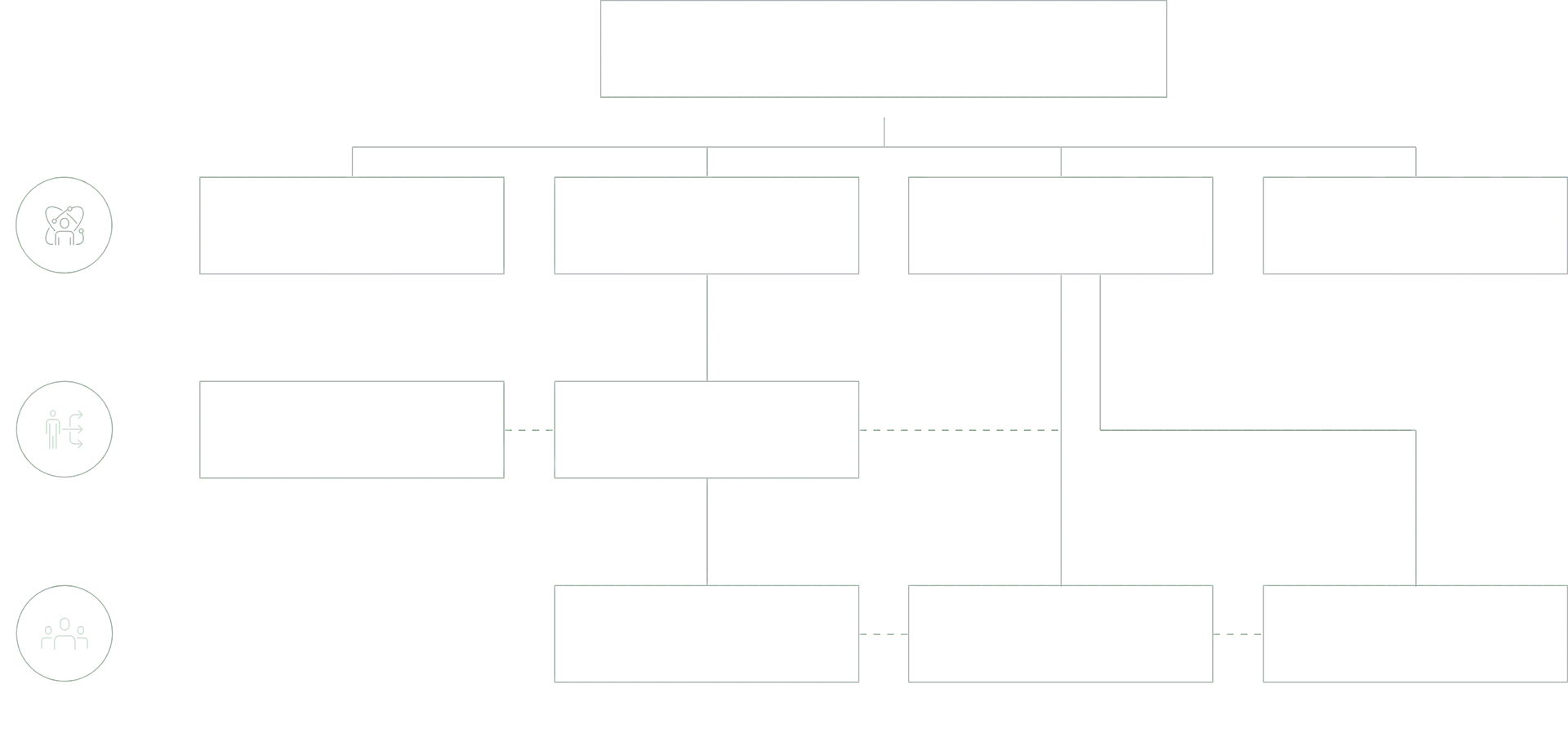

Risk Governance

SCBX has integrated risk management and considerations into every business process, with governance bodies overseeing coordinated efforts at every level, from the director and management down to the operational level. In addition, the Board of Directors is responsible for formulating SCBX Group Risk Management Policy, covering relevant risks and business continuity management of the Group, including internal control to ensure that SCBX Group has in place a risk governance framework that fosters a risk culture.

At the same time, sub-committees are responsible for overseeing, supporting, reviewing, and ensuring that SCBX Group has in place appropriate policies and strategies covering key risks and emerging risks under management of the Risk Office, tasked with driving group-wide risk management practice.

Risk Management Process

SCBX manages risks systematically and continuously through a review of risks and risk levels, scenario analysis, stress testing, defining business continuity management plans, organizing regular training sessions, and regularly auditing the risk management process.

Risk Identification

SCBX has identified key material risks and reviews business operations and strategies across the entire Group on a regular basis to assess any emerging risk that could become material to the SCBX Group.

Risk Assessment and Measurement

SCBX performs risk self-assessment and measurement to identify the likelihood and potential severity of any impact of risks to operations, using a wide range of quantitative and qualitative methods. SCBX also performs stress tests to implement forward-looking risk management.

Risk Control and Monitoring

The SCBX Group has established Group Risk Appetite Statements for key risk indicators and risk limits to control and monitor pre-specified material risks with plans to manage and mitigate any risk impacts.

Key Material Risks

Read details of key material risks in the annual report of SCBX.

Risk Identification

SCBX has identified key material risks and reviews business operations and strategies across the entire Group on a regular basis to assess any emerging risk that could become material to the SCBX Group.

Risk Assessment and Measurement

SCBX performs risk self-assessment and measurement to identify the likelihood and potential severity of any impact of risks to operations, using a wide range of quantitative and qualitative methods. SCBX also performs stress tests to implement forward-looking risk management.

Risk Control and Monitoring

The SCBX Group has established Group Risk Appetite Statements for key risk indicators and risk limits to control and monitor pre-specified material risks with plans to manage and mitigate any risk impacts.

Key Material Risks

- Strategic Risk

- Credit Risk

- Investment Risk

- Liquidity Risk

- Market Risk

- Technology and ICT Risk

- Operational Risk

- Legal and Compliance Risk

- Reputational Risk

- People Risk

- Model and Artificial Intelligence (AI) Risk

- Environmental, Social and Governance (ESG) Risk

Emerging Risks

The current business context consistently exposes organizations to unprecedented external risk factors, ranging from geo-political conflicts, political instability and disturbances, macro-economic disruptive changes, natural disasters, terrorism, cyber-attacks, pandemics, as well as supply chain disruptions. SCBX continues to manage these risks through simulation models and stress testing while deploying business continuity plans with periodic tests which are specified as part of enterprise risk management.

SCBX reviews emerging risks resulting from events or factors that may cause mid-to-long-term disruptions to the company’s business models or activities.

QuantumComputing